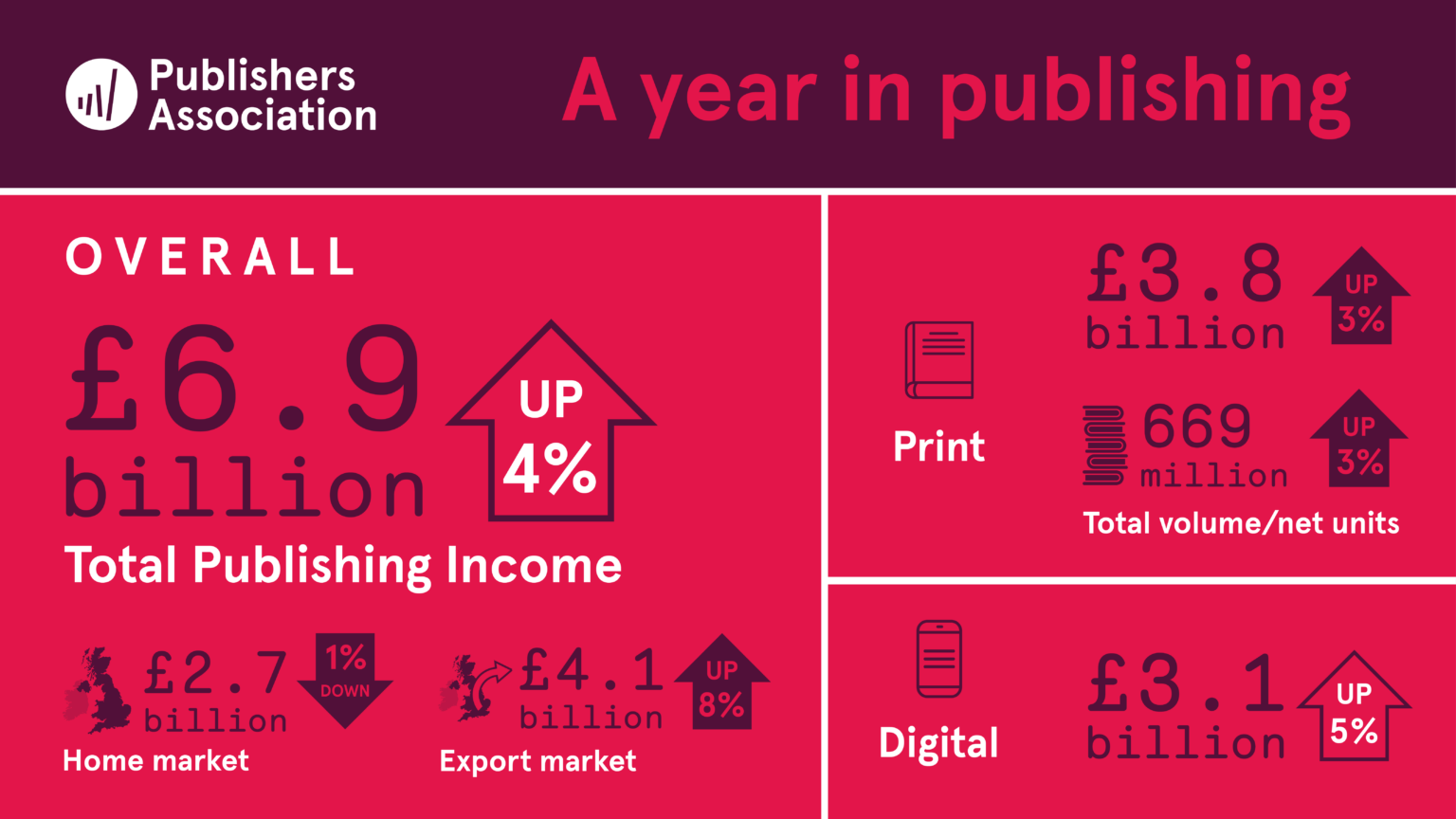

The growth of UK publishing has been phenomenal in recent years: according to a new report from the UK Publishing Association for the 2023 London Book Fair, sales increased by 4% between 2021 and 2022 (to £6.9 billion or $8.6 billion), the highest ever level in publishing!

The reports are a great overview of the key trends, changes and developments in the UK publishing industry. Based on the source, this essentially data coming from big publishers and a selection of smaller mainstream publishers, but it doesn’t include UK indie authors or Amazon UK sales, so we can safely say the real UK ebook numbers will be higher than stated.

Here are some of our favorite takeaways:

- The total UK publishing market is down slightly, but its world export market has increased by 8% in one year.

- Even with some small declines in some segments of print, UK publishing sales have increased in all formats: print is up 3% to $4.7 billion over 669 million units, and digital books are up 5% to $3.9 billion.

- The UK domestic market fell last year by 1% to approximately $3.4 billion, but exports to the rest of the world were almost double the size of the domestic market, an equivalent of $5 billion.

A Dramatic Growth in Exports

- Germany was the third biggest EXPORT market for the UK after Australia and the USA.

- Digital exports from the UK were worth $201 million last year.

- Print sales UK were up 3% by revenue to $4.7 billion and up 3% by unit volume at 669 million units. Digital up an astonishing 5% percent and worth $4.3 billion, and rapidly catching up to print. Currency fluctuations are a significant part of this when it comes to revenue, and one reason why unit volume needs also to be factored in when we draw conclusions from the "official" data.

- Digital education exports up 16% to $73 million, mainly to Spain, the UAE and Egypt. Schools everywhere (where they have internet stability) are shifting to digital education, and the English-language are rich in high-quality, high-demand exportable educational publications.

- In the academic market, content from key authors and publishers is being licensed by tech firms for tech and data mining because it is a credible source in an age of AI, social media, and disinformation.

What we see in these numbers is a global appetite for English-language titles, particularly in educational markets. Selling beyond home markets for all English publishers—of all sizes, including the US, Canada and Australia can be huge. If publishers are not exporting titles, they are missing out. Of course, StreetLib can help any publisher with wider global reach.